I am still following the dramatic price fall of apple stocks over the last days, as mentioned below as soon as there are first signs of medium upside momentum it is time to go long for two years. Autocorrelation is higher in markets than assumed. (Carhart four factor model)

Could somebody please realize that cash has never been so cheap!

Check out the link below:

http://tech.fortune.cnn.com/2013/04/19/apple-share-price-earnings-pe/

On the other hand a contrarian view:

http://blogs.wsj.com/moneybeat/2013/04/18/apple-shares-are-dirt-cheap-so-what/

According to Nassim Taleb, the risk in large companies is always higher than expected. Large companies tend to disappear over time. This is in the nature of businesses and growth perspectives are limited. Therefore place more bets into small caps. Despite growth apple still might just be a valid cash machine.

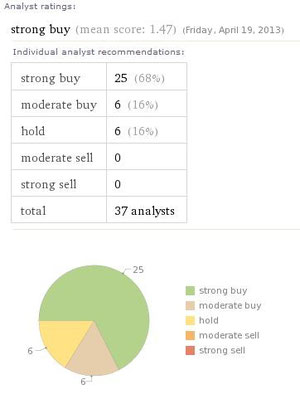

Of course analysts herd and are biased due to incentives. One should not follow buy recommendations, but sell recommendations are definitely a signal for caution, so far green light.

Write a comment

Erik (Saturday, 20 April 2013 22:15)

My opinion,

fundamental numbers are excellent!

I mean they have been excellent since years except it was never so cheap to buy stocks of Apple.

MY OPINION TO TECHNICAL ANALYSES

I do not really understand technical analyses and I doubt that many traders do so! These analyses often remind me of self illusion. Traders need to justify their buying/selling operations and pretend to realise some sort of pattern on the stock’s chart.

→ for them it can’t be just randomness. there must always be a pattern.

It is somehow similar to what psychologists call “illusion of competence”

I would love to buy but…..

Stocks rather perform on the markets future expectation on the companies' revenues right !?

And we can refer to two problems of the Apple here.

(1) The rather theoretic perspective of statistics and behaviour economics

(2) The technologic and brand perceived strength of Apple products

(1) CONTRAST/RELATIVE and LOSS AVERSION EFFECTS

People in general do not perceive absolute numbers so strongly if there is no anchor as a reference. In contrast when there are reference numbers and a direct relations can be drawn the perceived impact is much higher.

Let’s just have a look on Apple’s Ebit-Marge (2012) which was roughly around 37,5 % !!!

A pretty high number compared to Samsungs 15,5 %.

In addition Apple was able to shock / indulge the market every year with even higher revenues reaching that recent climax of 37,5 % in 2012.

Consequently Apple set the own standards so incredibly high for years now that they can hardly beat the own numbers in future anymore. Due to psychological effects every margin lets say, 30, 25, 20 % in the next years will be perceived as a loss rather than as a still fantastic outcome. Although it is still much higher than Samsungs Ebit Marge.

Furthermore the statistic feature of regression to mean value should be taken into account. Apple did extremely well in recent years. Consequently odds are rather in favour of a slightly worse performance.

(2) TECHNOLOGY AND BRAND, are Apple products still desirable ?

if you only consider the style! → yes, but there are a few alternative competitors

if you consider style and the pricing level, → not so sure…..

if you consider the hardware performance → No + the price → No No → + usability with new services → No No No.

Iphones had a share of roughly 50 % on 2012 turnover.

Ipads 20 %

Both products are too expensive nowadays and do not have unique advantages anymore.

Furthermore the premium market segment shows signs of saturation and Apple is not undoubtedly stylish or hip anymore.

On the contrary Andreoid based hardware is much cheaper (and better or catching up in more and more aspects) and could serve the high potential demographic markets in China, India, Brasil, Indonesia, Bangladesh …

SOME HOPE LEFTOVERSs:

Windows 8 backfiring at Microsoft earning shitstorms

Microsoft will cancel the famous XP series completely until 2014

→ Advantage for the MacOS system at the moment ?

BIG CASH RESERVES

Theoretically Apple could buy everything they need in order to catch up and compete with competitors.

But that increases risk a lot. Most of the time mergers are too expensive and the benefits and a successful integration are unsecure.

Fabian (Saturday, 20 April 2013 22:42)

Hello Erik,

Thanks a lot for your comments, valid points.

I want to look at it from a slightly different perspective. "A good company is not a good investment". So if we get a good discount margin on the price, even a bad company can be a good investment and I would like to emphasize that Apple is still fundamentally one of the best. I like your point about regression to the mean; this is also a reason to wait for an ever lower price. In case you look at the stock development over the last 5 years. As I said let’s wait and see how long the negative momentum continues and afterwards make a decision depending on the price.

Fabian (Saturday, 20 April 2013 22:57)

http://www.valueexplorer.com/analyzer/company/US0378331005/

@Erik take a look at the link above...

Fabian (Tuesday, 23 April 2013 21:46)

Bought into Apple (yesterday) at 390 stop at 358, will hold it for two years. I want to post it because we need more skin in the game. Markets are predictably irrational and there is a lot of randomness in terms of future returns so lets see how it goes...

erik (Tuesday, 23 April 2013 23:50)

for starters you caught a slight upward momentum there ;-)

Fabian (Wednesday, 15 May 2013 21:40)

Sold today for 430 not perfect but still an okay return, reason was better opportunities...